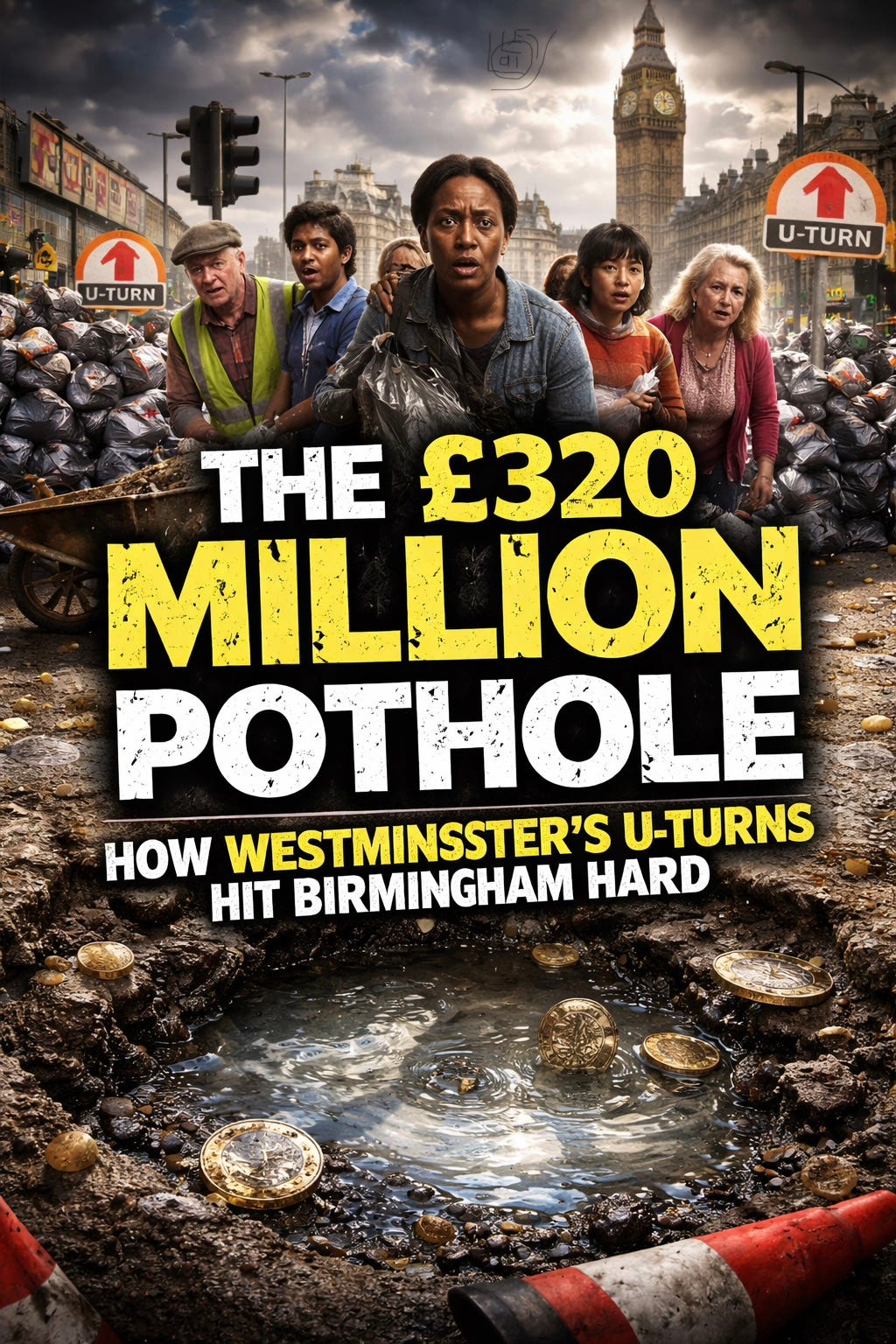

£320 Million of Wobble: How Westminster’s U-Turns Land on Birmingham’s Roads

Westminster rarely says out loud: U-turns do not just bruise reputations. They destabilise local economies.

Governments U-turn. It happens.

They promise one thing, discover the Treasury cupboard is barer than advertised, and quietly reverse out of the driveway.

A single U-turn is embarrassing.

Four or five is awkward.

A season of them starts to look less like prudence and more like someone repeatedly missing the junction.

And here is the part Westminster rarely says out loud: U-turns do not just bruise reputations. They destabilise local economies.

They ripple outward.

They rattle the funding formulas.

They tighten borrowing.

They inject uncertainty.

And in cities like Birmingham, already balancing on financial scaffolding, that wobble matters.

If you want to see what national instability looks like, do not watch the Commons.

Stand on a Birmingham road.

The Great Reversal Tour

Over roughly the past 12 to 18 months, the government has either softened, recalibrated, delayed or repositioned policy on:

Winter Fuel payments.

The two child benefit cap.

WASPI compensation.

National Insurance.

Income tax positioning.

Agricultural relief.

Pub business rates.

Benefits adjustments.

Debt fiscal rules.

Day one workers’ rights.

Digital ID.

Grooming gang inquiry structure.

Trans definition language.

Council election timing.

That is not one correction. That is a pattern.

Now, let us be fair. Some early reversals were classic “new government meets fiscal reality” moments. Winter Fuel positioning shifted quickly after backlash. National Insurance messaging softened within a budget cycle. Debt rule language evolved following market reaction.

That is Treasury wobble.

But then the reversals spread. They moved from spreadsheets into culture and process. Inquiry structures reframed. Definitions reworded. Election timing reconsidered.

When U-turns migrate from arithmetic into narrative control, it suggests heightened sensitivity.

And heightened sensitivity at the centre means instability at the edges.

Bring It Home to Birmingham

Birmingham accounts for roughly 1.6% of the UK population.

So if a national policy shift costs £1 billion, Birmingham’s notional share is about £16 million.

Not a direct invoice, but exposure within the fiscal envelope that shapes council settlements, welfare flows and borrowing terms.

Let us stack the larger fiscal ones conservatively.

Winter Fuel repositioning: £1 to £2 billion nationally. Birmingham share, £16 to £32 million.

Two child cap sensitivity: £1.5 to £3 billion. Birmingham share, £24 to £48 million.

WASPI compensation exposure: £3 to £10 billion one off. Birmingham share, £48 to £160 million.

National Insurance revenue sensitivity: £8 to £12 billion. Birmingham equivalent, £128 to £192 million.

Benefits adjustments: £2 to £5 billion. Birmingham share, £32 to £80 million.

Debt fiscal rule headroom shifts: £10 to £30 billion over the forecast horizon. Birmingham exposure equivalent, £160 to £480 million.

Now trim the overlap, keep it cautious, and you are still looking at roughly £300 to £400 million of Birmingham equivalent volatility sitting inside the national U-turn cycle.

Three hundred to four hundred million pounds.

That is not theatre.

That is asphalt.

The Road Ratio

Birmingham maintains around 1,600 miles of adopted carriageway.

Resurfacing a mile properly, not just filling a crater, costs roughly £200,000.

Do the arithmetic.

1,600 miles multiplied by £200,000 equals £320 million.

In other words, the mid range Birmingham share of Westminster’s fiscal wobble is roughly the same as resurfacing the entire road network of the city.

Every mile.

Every dip.

Every rut that collects rainwater.

You could, in theory, transform the visible condition of Birmingham’s roads for the same scale as one cycle of national policy instability.

That is the ratio.

The Bin Reality

Now take the bin dispute.

Even if settling it properly costs £30 million, that is barely a tenth of the volatility figure.

£30 million resurfaces around 150 miles of road.

£100 million resurfaces 500 miles.

£320 million resurfaces the lot.

When you translate billions into miles, the argument stops being abstract.

It becomes visible.

And Birmingham residents understand visible.

Even the Farms

Here is a small but delightful fact. Birmingham City Council owns the equivalent of two working farms.

It sounds faintly comic in a city defined by ring roads and retail parks. But it is a reminder that fiscal decisions ripple everywhere. Agricultural relief shifts affect land values, credit conditions and asset planning. Birmingham sits at the centre of supply chains. Rural policy does not stay rural for long.

The system is interconnected.

When it wobbles, the tremor spreads.

Why U-Turns Destabilise

Here is the crucial point.

A U-turn is not just an embarrassing headline.

It signals that assumptions have changed.

When assumptions change, markets adjust.

When markets adjust, borrowing shifts.

When borrowing shifts, councils hesitate.

Birmingham is already under exceptional financial oversight. It relies heavily on central grant. It has high welfare exposure. It is still stabilising after effective bankruptcy.

In that environment, stability from Westminster is oxygen.

Volatility is a headwind.

You do not see that in a Budget speech.

You see it in delayed resurfacing schedules. In stretched maintenance cycles. In capital projects pushed back one more year.

You drive over it.

Is It Panic?

Not necessarily.

Governments adapt. Markets discipline. Political coalitions shift.

But the pattern matters.

Year one: fiscal corrections.

Year two: revenue recalibration.

Then increasingly rapid cultural and procedural repositioning.

When reversals cluster and tighten inside shorter windows, the impression changes from controlled adjustment to reactive management.

And reactive management introduces uncertainty.

Uncertainty tightens the whole system.

The Birmingham View

If £20 to £30 billion of fiscal sensitivity sits at national level, 1.6% of that sits in Birmingham’s orbit.

That is roughly £320 to £480 million of influence.

In a city with a net revenue budget around £3 billion, that scale matters.

It is the difference between planning confidently and bracing defensively.

Between resurfacing proactively and patching reactively.

Between resolving disputes swiftly and negotiating in instalments.

U-turns are politically awkward.

But economically, they are destabilising.

And in Birmingham, destabilisation does not show up in a spreadsheet.

It shows up in the road beneath your tyres.