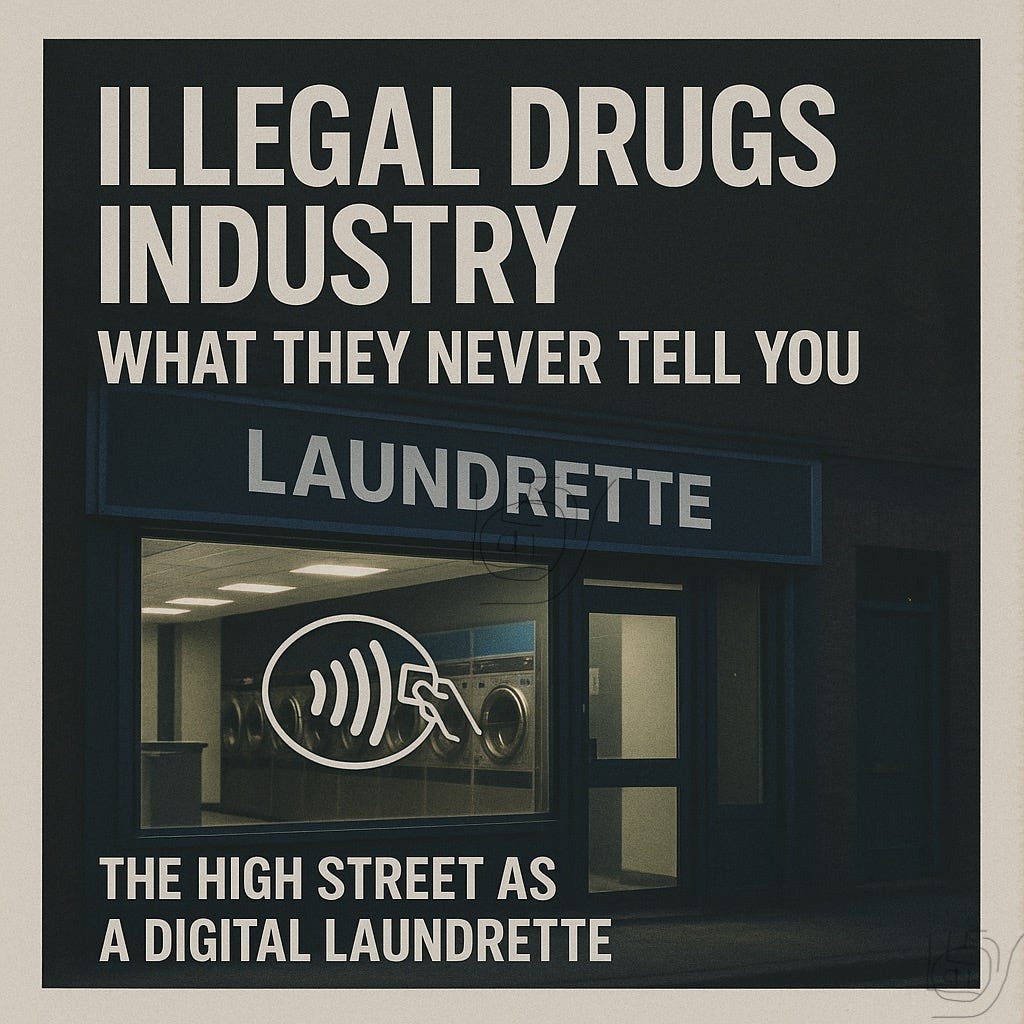

The Drugs Industry: The High Street as a Digital Laundrette

The first of a seven part series focussed on the illegal UK drugs trade: things you are never told by the authorities or the media.

Most people still imagine money laundering as something foreign and theatrical. A glamour of foreign banks, quiet men in suits, offshore accounts and silent handshakes behind tinted glass. It is comforting to believe it looks like that, because it places the danger somewhere else. Distant. Exotic. Not here.

The truth is simpler, uglier, and far closer to home.

It now lives on ordinary British high streets. It hums through card machines bolted to counters. It moves quietly through apps, terminals and digital rails built for speed and dressed up as innovation. The laundromat is no longer hidden. It is open for business, lit with LED signs, and never more than a mile away.

Walk any tired town centre and you will see the pattern. Businesses that do not make commercial sense in a rational economy, yet survive year after year. Vape shops that are never busy. Phone repair stores with no visible trade. Nail bars with more staff than customers. Dessert lounges glowing late into the night with empty tables. Candy shops selling overpriced boxes that gather dust. Premises that should have failed long ago by any honest measure of profit and loss.

They do not exist to sell. They exist to process.

On paper, they are thriving. Card turnover that suggests queues out the door. VAT returns that point to constant activity. Bank statements dressed up as evidence of commercial success. In the real world, they are silent. Quiet floors. Idle staff. Locked doors during peak trading hours. This is the modern contradiction of laundering. Busy on paper, quiet in person.

The engine of this system is not cash. It is the card machine.

A terminal is no longer just a way to accept payment. It is a tool for manufacturing turnover. Phantom transactions can be run through merchant accounts with no customer present, no product sold, no service rendered. Money circles through linked accounts. Small amounts, believable amounts, repeated so often they begin to look like genuine trade. Haircuts. Repairs. Snacks. Impulse buys. The choreography of everyday commerce, performed without an audience.

Historically, laundering relied on physical cash. Notes stuffed into tills. Inflated sales. Fake invoices. Bulk handling. Heavy risk. Heavy surveillance. Cash has weight. Smell. Suspicion. Digital money does not. It moves at the speed of light and leaves a trace that looks like ordinary business rather than criminal enterprise.

This is where challenger banks and fintech enter the story.

What was sold to the public as disruption was, in truth, a structural gift to organised crime. Faster onboarding. Minimal face to face checks. Automated compliance. Algorithmic comfort. Open an account in minutes. Spin up a merchant facility without a handshake. Connect payment gateways to shell companies that exist only as records on a register. For legitimate entrepreneurs, this removed friction. For criminals, it removed risk.

The older banks were slow and deeply annoying. They asked questions. They delayed transfers. They wanted explanations for sudden spikes in turnover. They insisted on forms, interviews and paperwork. Fintech culture replaced that suspicion with scale. Speed trumped scrutiny. Growth trumped judgement. Where volume was rewarded, laundering flourished.

Meanwhile, violence still commands the headlines. Knives. Gangs. Riots. Smash and grab. The spectacle of crime is easier to report, easier to police, and easier to politicise. There are sirens, blood, shattered glass and dramatic footage. Digital laundering has none of that theatre. It does not shout. It processes. It clears.

A phantom payment settling through a card network makes no noise. A fake revenue stream passing through a payment gateway leaves no broken windows. An account filing false but plausible numbers creates no scene tape, no flashing lights, and no outraged press conference.

This is why it has expanded so successfully.

Experts say that sums of a few hundred pounds a day are consistent with small, local drug networks rather than major organised crime. Such operations often rely on apparently legitimate small businesses to feed cash into the financial system, with shop owners typically receiving only modest compensation despite carrying serious legal risk. Not because it is harmless, but because it is boring. It lives in spreadsheets instead of crime scenes. It lives in terminals instead of weapons. It sits inside respectable entities that look like entrepreneurship rather than criminal ecosystems.

There is also a national blind spot. We like the story of enterprise. We want to believe in small business grit. We applaud shop fronts. We trust terminals. We assume that the presence of a card machine means a real transaction has taken place. Criminals have understood that if they borrow the language of legitimacy, they can move unseen.

And so the money does not go around the system any more. It goes through it.

Drug money does not hide offshore first. It enters card networks, challenger banks, digital wallets and payment processors almost immediately. It is broken into believable fragments and washed in transactions that look like lattes, haircuts, repairs and impulse sweets. By the time it reaches its destination, it smells like commerce, not crime. It looks like entrepreneurship, not exploitation.

There is comfort in believing this happens elsewhere. That it is a problem for other cities, other streets, other people. But the reality is mechanical and close. It sits in plain sight. It operates under respectable signage. It hums inside card machines screwed into counters of silent shops.

It is not happening in alleyways. It is happening in daylight.

The most effective laundromat in modern Britain is not hidden. It is open six days a week, nine to five, with a contactless symbol in the window and no customers in sight.

It is never more than a mile away.

Look out for part 2 soon … the bank’s role in sports the drugs trade ..!!